U.S. retail sales data for June exceeded expectations, with core data increasing by 0.9% month-on-month, significantly outperforming the expected 0.2% and the previous value of 0.4%, and even higher than Wall Street's most optimistic forecast of 0.5%.

Commentators suggest that this indicates consumers still have spending power at the end of the second quarter, and the main driver of the U.S. economy remains robust amid receding inflation and the Federal Reserve's approach to starting interest rate cuts.

The data led to a short-term rise in U.S. Treasury yields and the U.S. dollar, and a short-term decline of about $4 in spot gold prices. Subsequently, U.S. Treasury yields fell back, and spot gold reached a new high, breaking through $2,460. Affected by the strengthening dollar and weak oil demand, oil prices fell by more than 1.3% at one point.

The CME FedWatch Tool indicates that traders predict a 100% chance of the Federal Reserve cutting interest rates in September, with a 93.3% probability of a 25 basis point cut to the 5.00%-5.25% range, and a 6.7% chance of a 50 basis point cut.

Advertisement

Internationally, for the first time since June 21, traders have fully priced in two interest rate cuts by the Bank of England this year, each by 25 basis points, with the 2-year UK government bond yield falling below 4% for the first time this year.

The Dow and S&P reached historical highs, with small-cap indices surging by 3.5%, Apple hitting a new high, and Chinese concept stocks rebounding.

The market is no longer limited to technology stocks, and the rotation of funds continues. On Tuesday, July 16th, the technology-heavy Nasdaq initially rose by nearly 0.6% close to its historical high, then turned down by nearly 0.5% at noon; the S&P 500 index set a new intraday high and closed at a historical high; the Dow Jones, which is rich in blue-chip stocks, continued to rise, with the highest increase of nearly 2% or 777 points, approaching 41,000 points, marking the best single-day performance in over a year, setting a new intraday high and closing at a historical high; the Russell 2000 small-cap stocks also led the main indices again, accelerating upward and closing at the daily high; the Nasdaq 100 fell throughout the day and closed with a slight increase of 0.06%.

As of the close, all major U.S. stock indices closed higher, with the Dow and S&P 500 reaching historical highs, the Dow rising for five consecutive days, small-cap stocks rising by 3.5%, which is the largest relative increase among the main indices, rising to the highest in two and a half years since January 2022, with a cumulative increase of nearly 12% over five consecutive days, and the regional bank index rising by more than 4.5% and rising for six consecutive days to the highest in over a year:

The S&P 500 index closed up 35.98 points, a gain of 0.64%, at 5,667.20 points. The Dow closed up 742.76 points, a gain of 1.85%, at 40,954.48 points. The Nasdaq closed up 36.77 points, a gain of 0.20%, at 18,509.34 points.

The Nasdaq 100 index closed up 0.06%; the Nasdaq Technology Market Value Weighted Index (NDXTMC), which measures the performance of technology stocks in the Nasdaq 100, closed down 0.56%; the VIX volatility index closed up 0.53% at 13.19.The Russell 2000 small-cap index closed up 3.50%. In the last four trading days, the Russell 2000 has outperformed the Nasdaq 100 by 11%, marking the largest margin since 2011. Among the constituents of the Russell 2000, Pacific Biosciences of California (PACB) surged 34.26%, and Caribou Biosciences rose 28.17%. ANGO, EB, PRPL, EGHT, and PAYS saw gains ranging from 26.64% to 20.55%, making them at least the seventh-largest gainers. Funko closed down 7.66%, making it the second-worst performer, while ASPI fell 8.88%, the worst.

The Philadelphia Stock Exchange KBW Bank Index rose 3.02%, hitting a new closing high since February 2023. State Street Bank led the gain with a 7.45% increase, Wells Fargo rose over 4%, Citigroup jumped over 3%, JPMorgan Chase increased by 1.7%, and Goldman Sachs climbed over 2% to a new high. Meanwhile, Charles Schwab, which missed expectations for new brokerage accounts in the second quarter, plummeted over 10%. Morgan Stanley, which slightly missed wealth management net revenue expectations, rose nearly 1%. Bank of America, which exceeded transaction revenue expectations in the second quarter excluding DVA, climbed over 5%.

The Dow Jones KBW Regional Banking Index jumped 4.54%, with all 47 constituents closing higher. WSFS Financial led with a 7.13% increase, while Commerce Bancshares was the "worst performer" with a 2.84% gain.

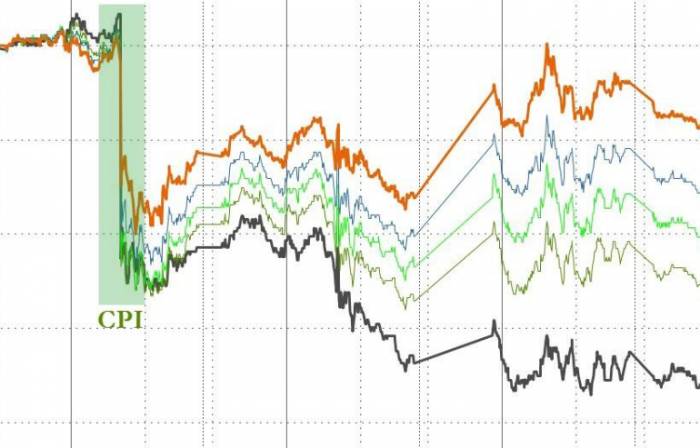

Since last week's "weak" CPI data release, the Russell 2000 has soared over 10%, while the Nasdaq 100 has declined.

Among the 11 sectors of the S&P 500, the S&P Industrials sector closed up 2.54%, with Materials, Consumer Discretionary, Health Care, Financials, and Real Estate sectors rising between 1.96% and 1.03%. The Energy sector had the smallest gain of 0.35%, while the Information Technology/Tech sector closed down 0.38%, and the Telecommunications sector fell 0.64%.

Analysis indicates that the market continues to show a very pronounced rotation, with small-cap stocks outperforming large-cap stocks, low-momentum stocks outperforming high-momentum stocks, growth stocks outperforming cyclical stocks, and heavily shorted stocks outperforming long stocks. Goldman Sachs stated that current trading volume is higher than the average of the past 20 days, indicating active trading activity. ETFs account for 28% of the share, showing that investors are heavily using ETFs for trading. Goldman Sachs' trading desk observed a slight market bias towards buying, with a 6% preference for buying over selling, especially led by limit orders. Demand is concentrated in the financial and health care sectors, while the tech and non-essential consumer goods sectors have more selling supply.

More than half of the "Tech Seven Sisters" fell, with several weakening in the afternoon and closing at their daily lows. Tesla performed the best, recovering from a drop of over 2.7% in the early US session to rise nearly 2.4% at the end of the day, closing up 1.55%. Apple initially rose nearly 0.8%, fell nearly 0.9% at midday, recovered to close higher, and ended up 0.18%, setting a new all-time high, with a market cap of $3.6 trillion, maintaining its first place. Amazon rose over 2%, then fell throughout the day, ending up 0.16%.

NVIDIA initially rose over 0.4%, then dived, closing down 1.62%, with a market cap of $3.11 trillion, ranking third in the US stock market. Microsoft fell nearly 1.5% at its lowest, ending down 0.98%. "Metaverse" Meta rose nearly 1.6%, then returned to a downtrend, closing down 1.28%. Google A initially rose over 1.1%, then turned down, ending down 1.4%.

Chip stocks showed mixed performances. The Philadelphia Semiconductor Index fell nearly 1.1% in the morning, but eventually rose 0.46%, still close to its historical high. The industry ETF SOXX rose 0.62%. NVIDIA's double leveraged ETF fell 3.32%; Qualcomm rose 0.7%, TSMC ADR rose 0.4%, Broadcom fell 1.19%, AMD fell 1.27%, and Micron Technology fell 2.58%.

AI concept stocks showed divergent trends. SoundHound.ai rose 3.55%, BigBear.ai rose 6.41%, and Snowflake rose 1.86%; while Oracle fell 0.32%, Dell fell 2.16%, CrowdStrike fell 2.2%, and Super Micro Computer fell 2.31%.In terms of news:

Tesla: Tesla has once again begun a significant hiring spree, planning to recruit nearly 800 new employees, following the largest layoffs in the company's history three months ago. Positions have been continuously posted on Tesla's job page in recent weeks, ranging from artificial intelligence experts to more common service roles. The stock has risen on all trading days during this period, with only one exception when it was reported that Tesla decided to delay the release of the Robotaxi. Musk confirmed on Monday that he had requested design modifications, granting the relevant team additional time.

According to LatePost, Tesla will not launch new car models for sale this year, but there may be a new battery. The Tesla battery department will focus on improving production yield and efficiency, and expanding capacity in the coming period.

Bank of America: In the three months ending June, net interest income, one of the bank's largest sources of revenue, fell to $13.7 billion. Earlier this year, the bank indicated that net interest income in the second quarter might be the lowest for the year, with the fourth-quarter net interest income (NII) potentially climbing to around $14.5 billion.

Most Chinese concept stocks rose. The China Internet Index ETF (KWEB) saw a significant narrowing of its decline to 0.32%; the China Technology Index ETF (CQQQ) closed up 1.43%; the NASDAQ Golden Dragon China Index (HXC) closed up 0.74%.

Among popular Chinese concept stocks, the new force in car manufacturing saw significant gains, with XPeng Motors up 6.55%, NIO Inc. up 5.83%, Li Auto up over 1.4%, and Zeekr up 3.32%; JD.com up over 2%, Bilibili up over 1.5%, Baidu up 0.62%, Alibaba up 0.47%, Canadian Solar Inc. closed up 9.25%, Daqo New Energy up about 8.6%, Jinko Energy up 7.3%, while Ctrip fell over 0.4%, Pinduoduo fell 1.56%, NetEase fell 0.82%, TAL Education fell about 1.5%, Atour Hotel fell about 2%, Kanzhun/Boss Zhipin fell over 2.7%, and Miniso Group fell 3.89%.

In terms of more volatile stocks:

Blockchain-related stocks generally closed higher, with Stronghold up over 16%, Riot Platforms up over 10%, 2x leveraged long Bitcoin ETF up over 5.6%, and 2x inverse Bitcoin ETF down over 5%.

Berkshire Hathaway Class B shares closed up 1.03%, and Class A shares up 1.13%, both setting new historical closing highs for several consecutive days.

European stocks fell for two consecutive days:The pan-European Stoxx 600 index closed down by 0.28%, at 517.30 points. The Eurozone STOXX 50 index closed down by 0.71%, at 4947.83 points. Among the Eurozone blue-chip stocks (constituents of the Eurozone STOXX 50 index), Kering Group, a constituent, fell by 3.1%, performing the worst.

The German DAX 30 index closed down by 0.39%; the French CAC 40 index closed down by 0.69%; the Italian FTSE MIB index closed down by 0.02%; the UK FTSE 100 index closed down by 0.22%; the Dutch AEX index closed down by 0.43%; the Spanish IBEX 35 index closed down by 0.96%.

Among the more volatile stocks, the German luxury goods company Hugo Boss closed down by 7.57%, following a significant downgrade in its full-year profit outlook, citing weak demand in key markets such as the UK. Burberry in the UK fell by 5.3%, after recent performance reports indicated a change in CEO and a profit warning, rethinking its high-end luxury strategy. The French insurance company SCR closed down by 24.56%.

Amid a global consumer downturn, the luxury goods industry is clouded with uncertainty. According to the media's billionaire index, market slowdowns have caused LVMH Group founder Bernard Arnault to lose his title as the world's richest person, with the top five luxury goods moguls' wealth evaporating by $24 billion.

U.S. Treasury yields fell across the board, with the 10-year U.S. Treasury yield falling by about 7 basis points, breaking below 4.16%, and the two-year UK government bond yield falling below 4% for the first time this year.

At the end of the day, the two-year U.S. Treasury yield, which is more sensitive to monetary policy, fell by 3.18 basis points, to 4.4256%, trading in the range of 4.4698%-4.4046%. The U.S. 10-year benchmark Treasury yield fell by 6.99 basis points, hitting a daily low of 4.1595%.

The benchmark 10-year German bund yield fell by 4.5 basis points at the end of the day, to 2.427%, hitting a daily low of 2.417% before the release of the U.S. June retail sales data. The two-year German bund yield fell by 3.6 basis points, to 2.763%, having hit a daily low of 2.745%.

The French 10-year government bond yield fell by 3.1 basis points, the Italian 10-year government bond yield fell by 4.8 basis points, the Spanish 10-year government bond yield fell by 3.9 basis points, and the Greek 10-year government bond yield fell by 3.6 basis points. The UK 10-year government bond yield fell by 5.2 basis points, to 4.049%.

Due to rising expectations that the Bank of England will soon begin to cut interest rates, the UK's two-year government bond yield fell below the psychological threshold of 4% for the first time this year, with the two-year UK government bond yield falling by 8.0 basis points, to 3.984%. Traders expect the Bank of England to cut rates by 51 basis points by the end of 2024, marking the first time since June 21 that they have fully priced in the expectation of two 25-basis-point rate cuts.

The German July ZEW economic sentiment index fell to 41.8, slightly above the expected value of 41, and down from 47.5 in June. Investor confidence in the German economy has deteriorated for the first time in a year due to industry failing to keep pace with the gradual recovery of other sectors. ZEW President Achim Wambach said in a statement: "The economic outlook is worsening, with German exports in May falling more than expected, political uncertainty in France, and a lack of clarity on future monetary policy from the European Central Bank, all contributing to this trend."The strengthening of the US dollar and weak demand have suppressed oil prices, with US oil falling by more than 1.4% to below $81, marking the largest single-day drop in over three weeks.

The US dollar has strengthened for two consecutive days, driving down oil prices, which have fallen for three days in a row to a low point in over three weeks. The WTI August crude oil futures settled down $1.15, a drop of more than 1.40%, at $80.76 per barrel. The Brent September crude oil futures settled down $1.12, a drop of about 1.32%, at $83.73 per barrel.

Before the US stock market opened, both US and Brent oil continued to decline and hit new daily lows, with US oil falling to $80.22 per barrel, a drop of more than 2% during the day, and Brent oil falling by more than 1.8% to $83.30 per barrel at its lowest, before both US and Brent oil rebounded and recovered some of the losses.

Analysts say that on the one hand, after the attempted assassination of Trump, the rise in the US dollar led to a decline in oil prices. On the other hand, the decline in China's crude oil imports has led to a decrease in oil demand, putting pressure on oil prices.

US August natural gas futures closed up 1.39% at $2.1880 per million British thermal units; the European benchmark TTF Dutch natural gas futures rose 4.55%, at €32.797 per megawatt-hour; ICE UK natural gas futures closed up 2.21%, at 80.76 pence per kilowatt-hour.

The US dollar gave back the short-term gains brought by the US retail sales data, and the yen broke below 159 again.

The US dollar index DXY, which measures against a basket of six major currencies, rose 0.04%, at 104.234 points, with the trading range during the day being 104.197-104.510 points, and it rose from near the daily low to the daily high after the release of the US retail sales data.

The Bloomberg US dollar index fell 0.03%, at 1251.76 points, with the trading range during the day being 1255.12-1251.61 points.

Non-US currencies generally fell. The euro against the US dollar made a V-shaped reversal and was roughly flat, and the British pound against the US dollar made a V-shaped reversal and was roughly flat.

The offshore renminbi (CNH) against the US dollar fell 145 points, at 7.2891 yuan, with the overall trading range during the day being 7.2730-7.2925 yuan.In the Asian currency market, the US dollar rose 0.18% against the Japanese yen, trading at 158.34 yen, and hit a daily high of 158.86 yen following the release of US retail sales data. The euro appreciated 0.39% against the yen, reaching 172.59 yen; the British pound gained 0.20% against the yen, standing at 205.443 yen.

After comparing the Bank of Japan's current account data with estimates from currency brokers, it appears that Japan may have intervened in the market on both Thursday and Friday last week to support the yen, with the intervention on Friday possibly amounting to around 2.14 trillion yen (13.5 billion USD). The Bank of Japan anticipates that its current account may decrease by 2.74 trillion yen on Wednesday due to government fiscal factors; private currency brokers such as Central Tanshi and Ueda Yagi Tanshi estimate an average decline of 600 billion yen.

Major cryptocurrencies experienced a general increase in value. Bitcoin, the largest by market capitalization, rose 1.98% to 64,960.00 USD. Ethereum, the second-largest, increased by 0.51%, trading at 3,463.00 USD.

The US Securities and Exchange Commission (SEC) has informed numerous asset management companies that a US Ethereum ETF may be launched on July 23rd (next Tuesday). Spot Ethereum ETF trading could commence from next week.

Amidst "interest rate cut trading" and the "Trump trade," spot gold reached a historical high, approaching 2,470 USD.

COMEX August gold futures closed up 1.71% at 2,470.4 USD per ounce, while COMEX September silver futures closed up 1.95% at 31.54 USD per ounce.

Lower US Treasury yields supported precious metal prices. Ahead of the US stock market opening, spot gold continued to rise, hitting a daily high just before the close, with the price surging by more than 1.8% to 2,466.61 USD per ounce, setting a new historical high and surpassing the previous high of 2,450.07 USD per ounce set on May 20th. Spot silver, after falling by more than 0.6% at the start of the US stock market session, accelerated its upward trend, rising by nearly 2.4% and breaking through 31.40 USD.

Analysts suggest that weak US data and dovish expectations from the Federal Reserve supported the rise in gold prices. Additionally, the attempted assassination of former US President Trump increased political uncertainty, and the escalating geopolitical risks worldwide (such as the European debt crisis, financial crisis, and Middle East geopolitical conflicts) further boosted the safe-haven demand for precious metals. The demand for gold from central banks around the world has been surging for several consecutive years. UBS stated last month that the scale of central bank gold purchases has reached the highest level since the late 1960s.

The rise of the US dollar led to a general decline in London's base metals. "Dr. Copper," an economic bellwether, fell by nearly 1.45%, trading at 9,664 USD per ton. London aluminum dropped by more than 2.27%, at 2,406 USD per ton. London lead closed down by 4 USD, at 2,184 USD per ton. London zinc fell by about 2.37%, at 2,885 USD per ton. London nickel closed down by 107 USD, at 16,594 USD per ton. London tin closed down by 75 USD, at 33,171 USD per ton.

Leave A Comment